The United Kingdom boosted hotel occupancy in Benidorm and is the only destination to match 2024 figures in the first half of May.

The rest of the Valencian Community recorded lower figures than last year, although the greatest differences are still concentrated in Valencia and its province.

Despite this, Valencia has the best hotel occupancy rate as a destination in the entire Valencian Community with an average of 83.5%.

Hotel occupancy data for the first half of May 2025, compiled by BigDataHosbec, are now available.

The most notable data from this survey is the growth of British tourists in Benidorm , representing more than 50% of the market share. Together with the rest of the international tourists, this means that practically 2 out of every 3 tourists staying in Benidorm hotels come from outside our borders, and that the average occupancy figure for 2024 has been repeated at 82.5%.

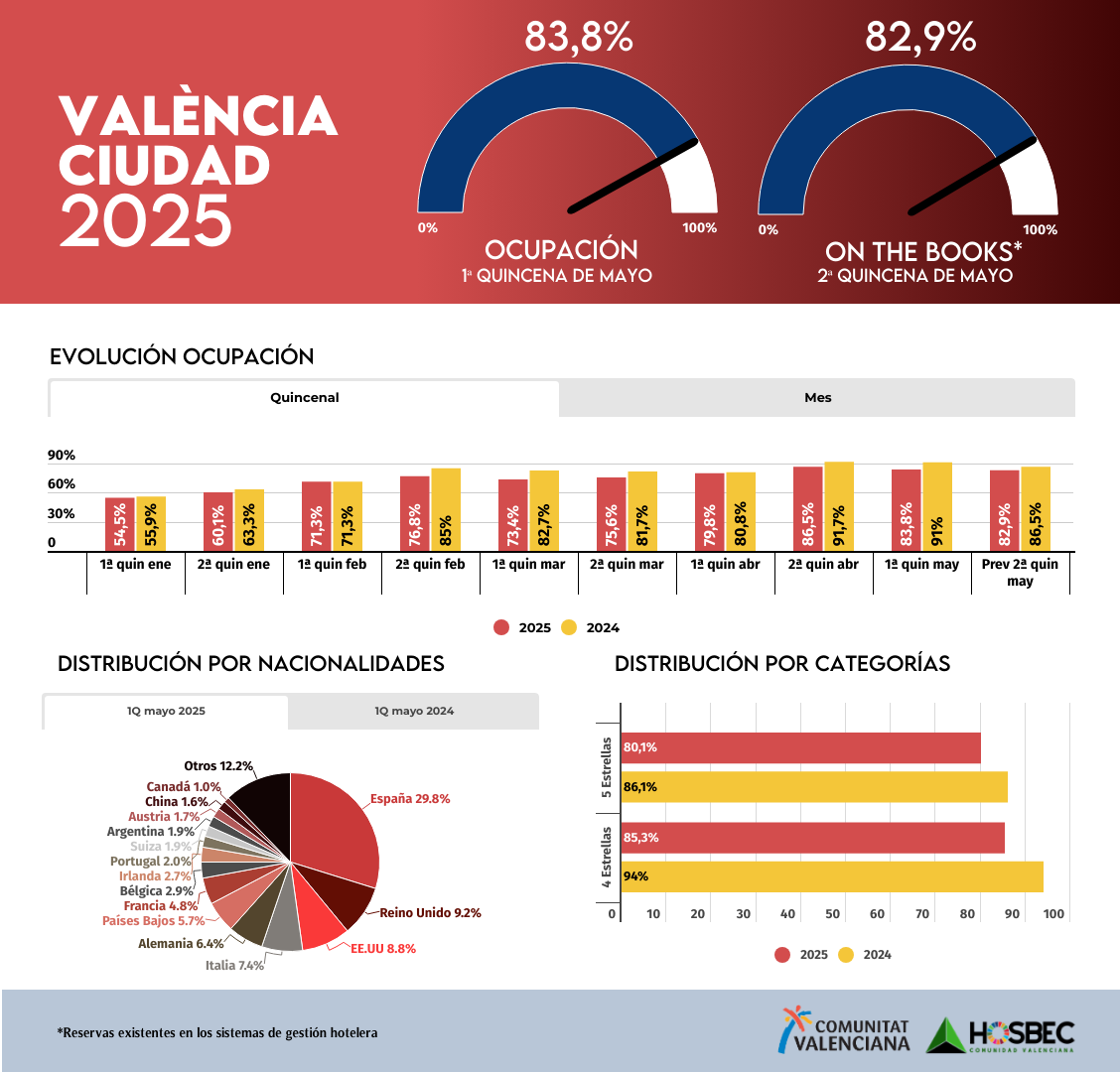

In the rest of the tourist destinations in the Valencian Community, the figures for the first two weeks of the month were lower than those for 2024, although the largest gap remains in Valencia and its province , areas where hotel occupancy was seven to eight points lower than last year.

Despite this, the capital of the Turia River has recorded the highest average figure in the entire Valencian Community, at 83.5%. Furthermore, its international market stands out once again, accounting for over 70% of the total , with the British also eyeing Valencia with a 9.2% share, and the US market following closely behind with 8.8%.

The city of Valencia also faces an additional economic component : its average rates and revenue per available room are 10% lower than last year , compromising its profitability in all these post-COVID-19 months. This factor, unlike the significant growth seen in the rest of Spain, requires a specific action plan and intensified promotion of Valencia to overcome the collateral effects of COVID-19 on tourism activity before the summer of 2025.

Alicante Sur has followed in the footsteps of Benidorm and Valencia, becoming the third destination in hotel occupancy, reaching almost 83% , while the average for the province of Alicante is 77.1%.

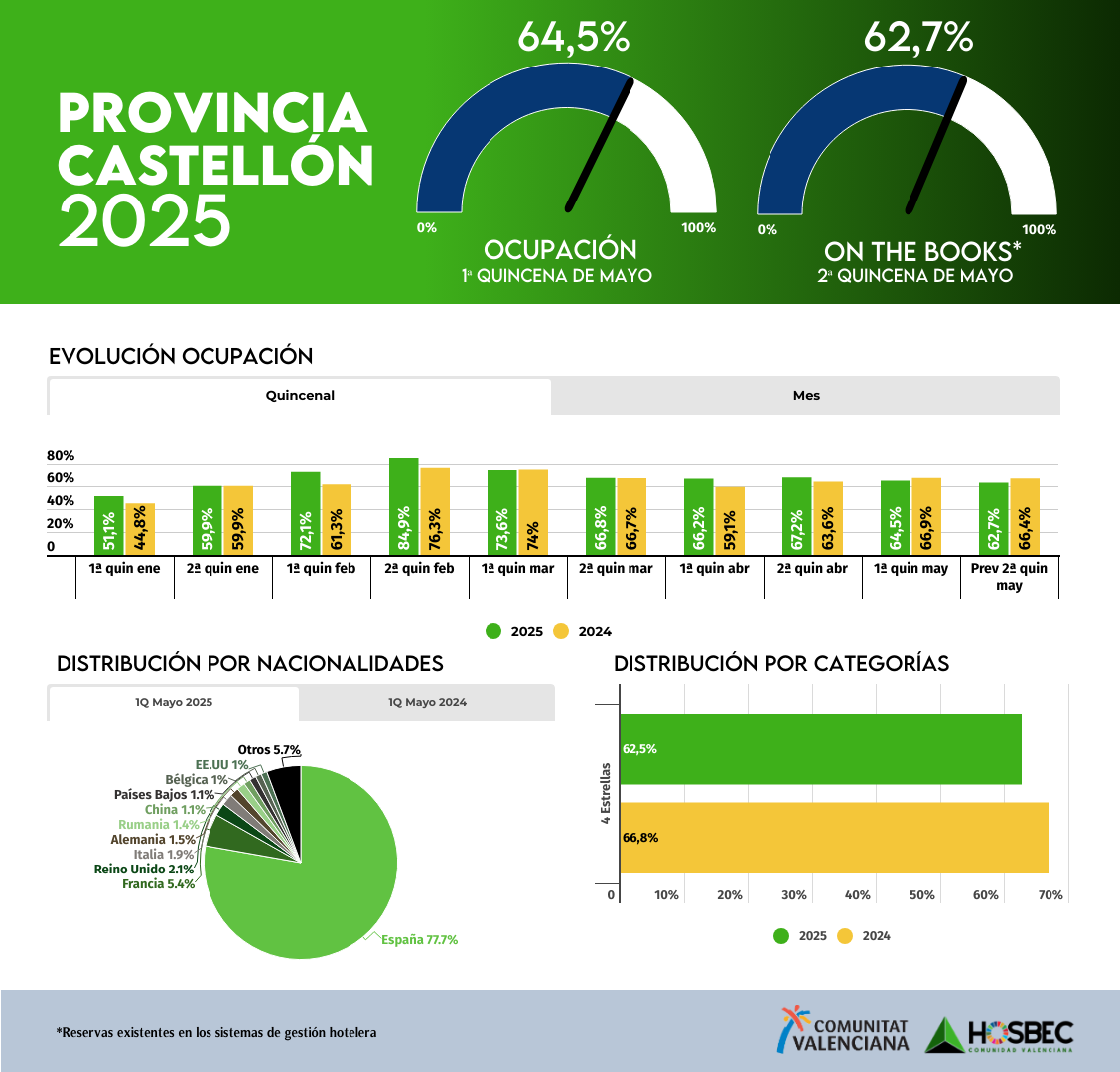

Castellón lost 2.5 points in hotel occupancy, registering 64.5%, shifting the weight of the domestic market over the international market in this province: 78% of hotel tourists in Castellón are Spanish, compared to 22% international , with the French in this case as the main market with 5.4%.

You can view the full report at the following link:

Biweekly report on hotel occupancy evolution – 1st half of May 2025

Below, we offer a detailed analysis of hotel occupancy rates in different locations throughout the Valencian Community.

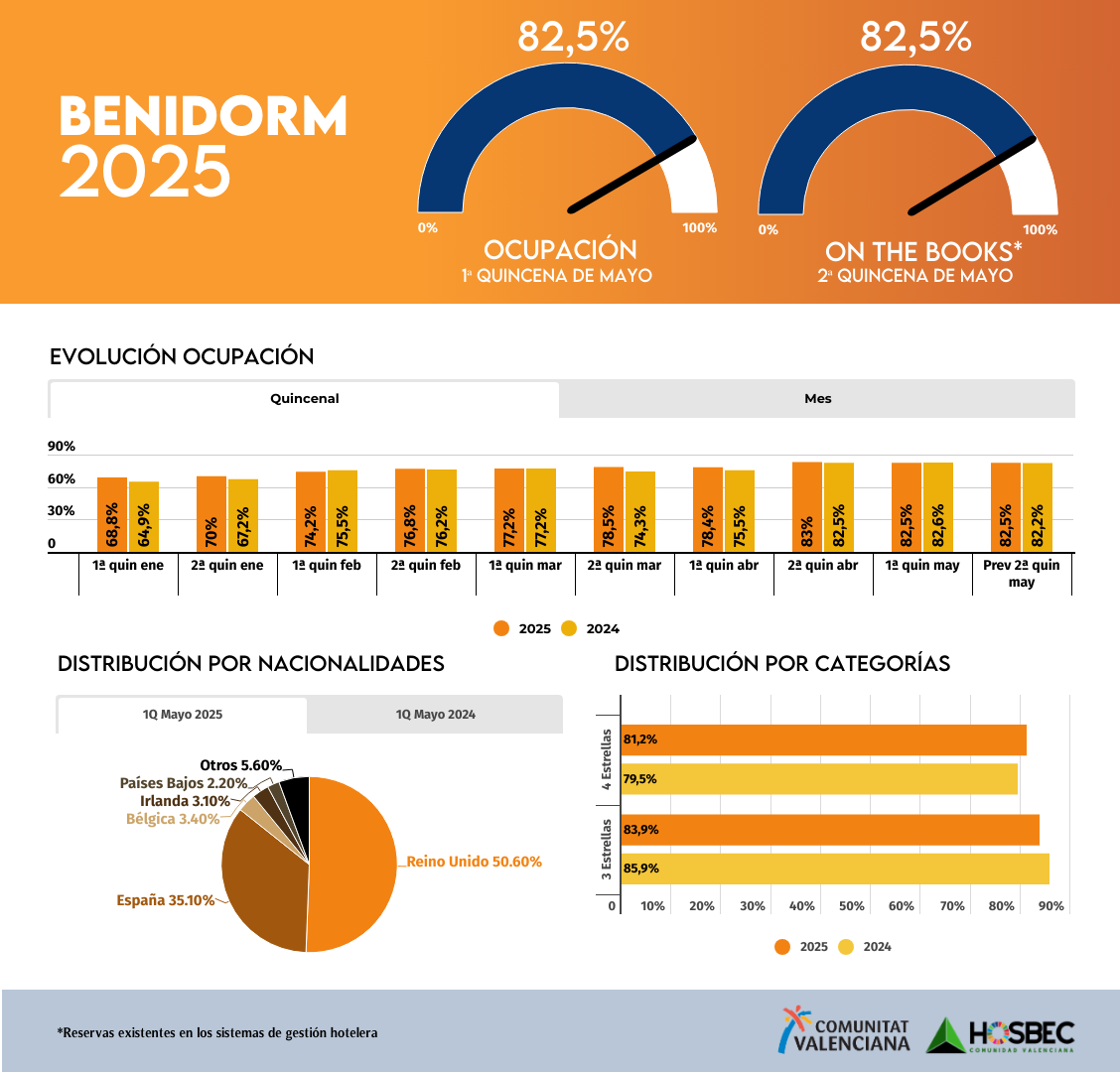

BENIDORM

Benidorm maintains a hotel occupancy rate of 82.5% during the first half of May 2025 , virtually unchanged from the 82.6% recorded during the same period last year, thus consolidating its position as one of the most solid tourist destinations in the Valencian Community.

By nationality, the British market continues to lead with a 50.6% share , expanding its dominance from 47.8% the previous year. It is followed by the Spanish market , which represents 35.1% , a slight decrease compared to 37.9% in 2024. The main source markets are completed by Belgium (3.4%) , Ireland (3.1%) , and the Netherlands (2.2%) .

In terms of occupancy by hotel category , 4-star establishments improved their performance to 81.2% (compared to 79.5% in 2024), while 3-star establishments recorded a decline to 83.9% , compared to 85.9% last year.

The forecast for the second half of May is also at 82.5% , which indicates continued strong performance by the hotel sector in the main tourist destination on the Costa Blanca.

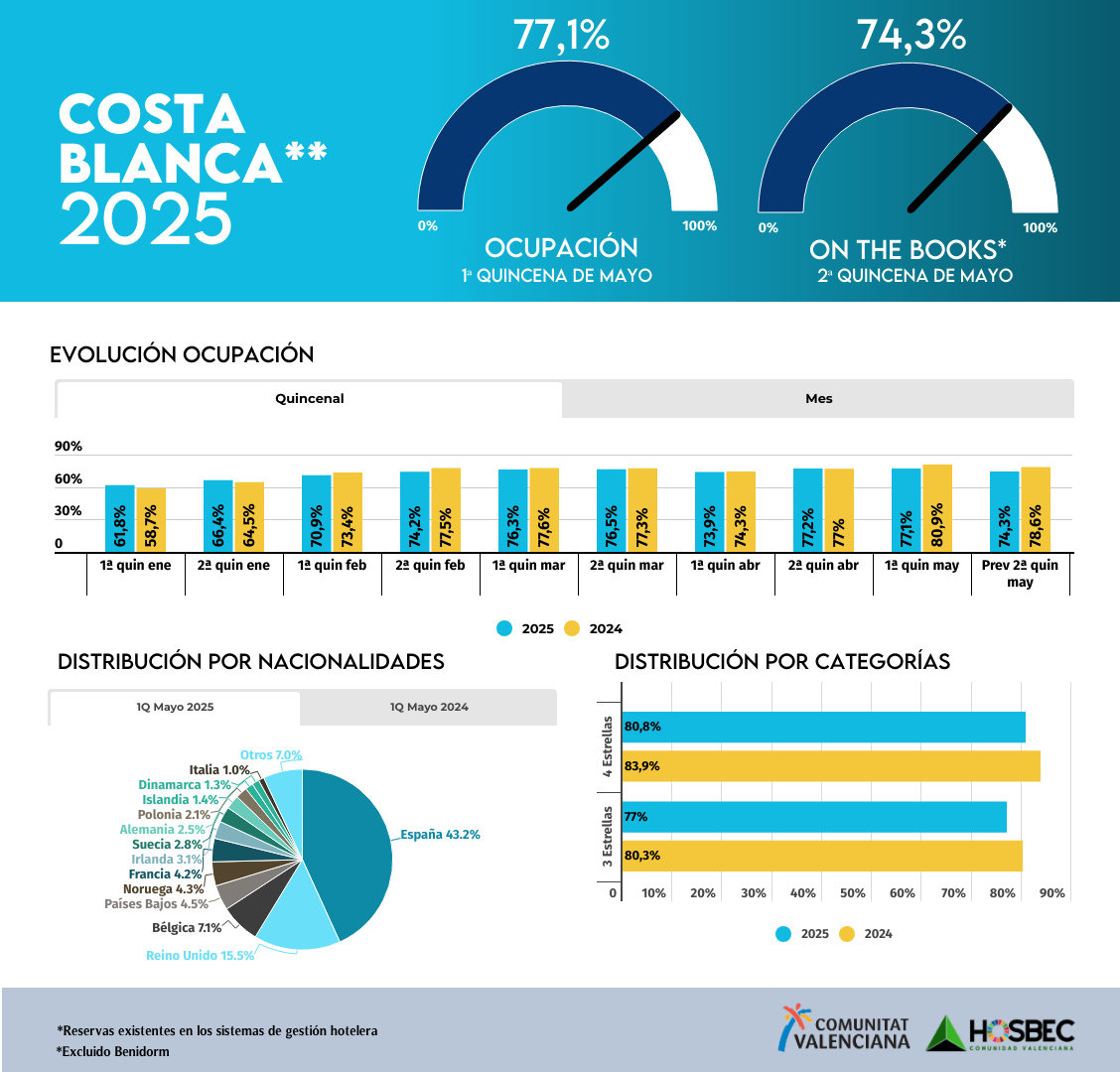

COSTA BLANCA AND ALICANTE SOUTH

Hotel occupancy on the Costa Blanca during the first half of May 2025 stood at 77.1% , a decrease of 3.8 points compared to the same period last year (80.9%). This adjustment comes amid a slight moderation in domestic demand, which remains the predominant market with 43.2% of the total, followed by the United Kingdom (15.5%) and Belgium (7.1%). Also notable are the contributions of the Netherlands, Norway, and France, which maintain a stable presence.

In terms of hotel categories, 4-star establishments are recording an occupancy rate of 80.8% , while 3-star establishments are at 77% , both slightly below the 2024 figures. Looking ahead to the second half of the month, the forecast is for an occupancy rate of 74.3% , reflecting a trend towards stability without the peak demand of holiday weeks.

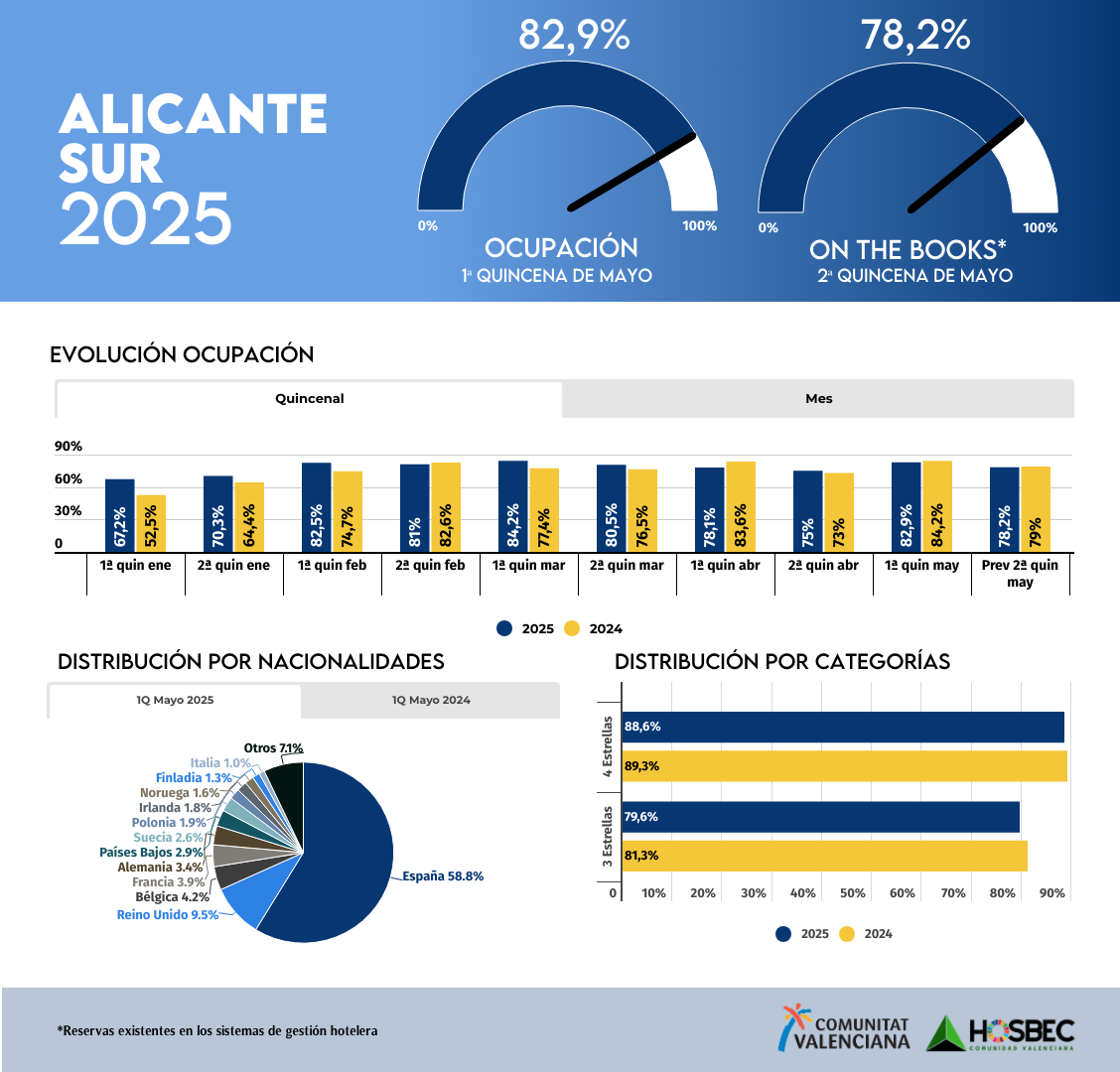

Within the Costa Blanca, the positive performance of the Alicante South area stands out , with occupancy at 82.9% in the first half of May, remaining at high levels despite slightly declining compared to 2024 (84.2%). This destination reinforces its dependence on the domestic market , which represents a significant 58.8% of the total. Even so, a diversification of international demand is observed, with the presence of the United Kingdom, Belgium, France, Germany, and the Netherlands.

Four-star hotels in this area have achieved an excellent occupancy rate of 88.6% , while three-star hotels have reached 79.6% , both slightly down year-on-year but still at significant levels. The forecast for the second half of the month is 78.2% , indicating continued good tourist activity in the area.

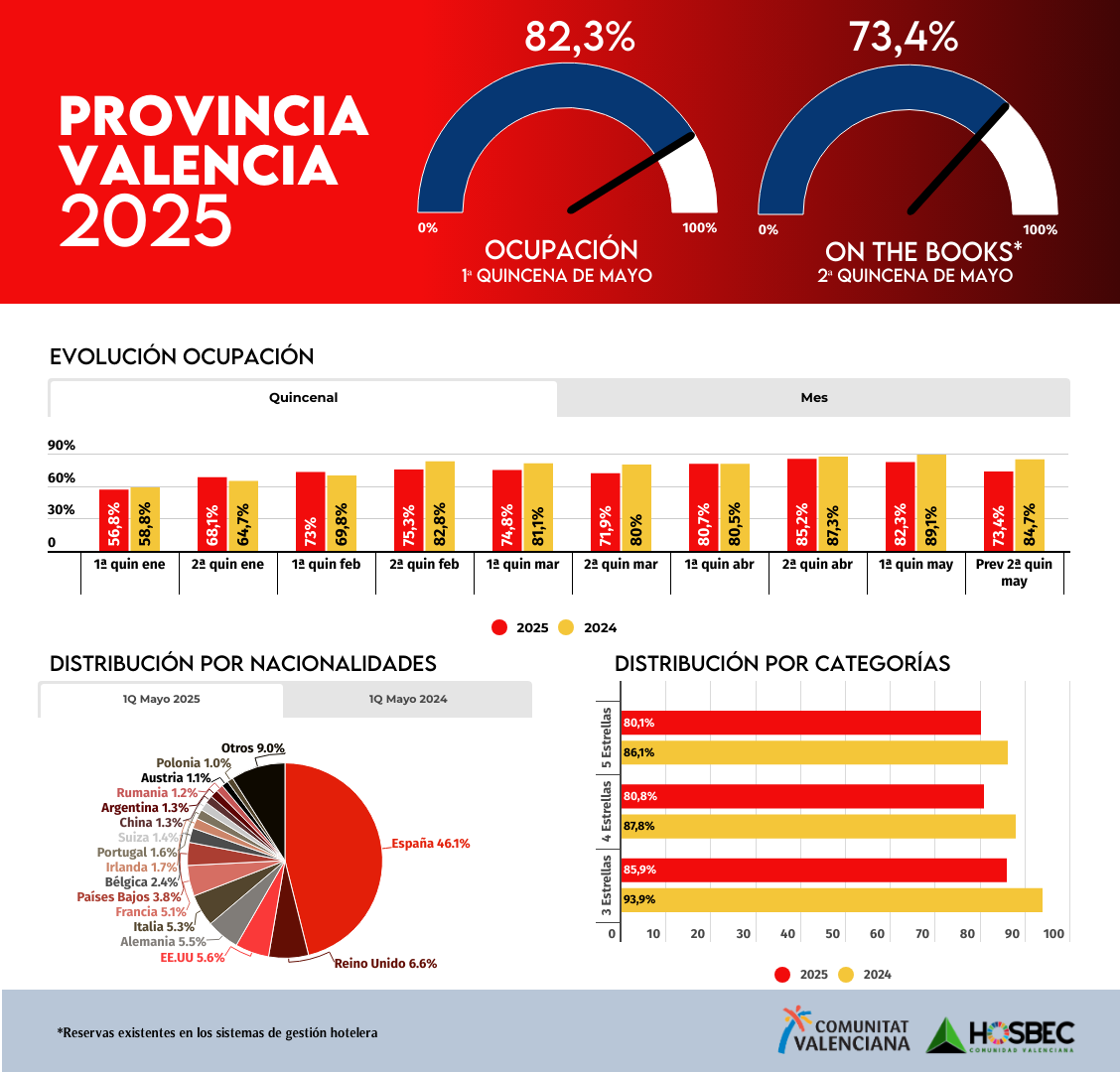

PROVINCE OF VALENCIA AND VALENCIA CITY

During the first half of May 2025, the Province of Valencia recorded a hotel occupancy rate of 82.3% , a drop of almost 7 points compared to the same period in 2024 (89.1%). This adjustment affects all hotel categories, but especially 3-star establishments , which fell from 93.9% to 85.9% , while 4-star establishments fell to 80.8% and 5-star establishments to 80.1% .

The domestic market continues to lead demand with 46.1% , followed by the United Kingdom, the United States, Germany, Italy, and France, which maintain a fairly balanced distribution. The diversity of European and American markets also remains, with significant contributions from the Netherlands, Belgium, Ireland, Switzerland, Argentina, and China.

Looking ahead to the second half of May , the occupancy forecast is 73.4% , in line with the slight moderation in demand observed this year.

In Valencia city , hotel occupancy was 83.8% , a solid figure although below the 91% reached in the same fortnight of 2024. The trend remains similar to that of the province as a whole, although with a more internationalized profile: national tourism represents 29.8% of the total, compared to 31.3% last year.

Among the source markets, the United Kingdom (9.2%), the United States (8.8%), Italy (7.4%), Germany (6.4%), and the Netherlands (5.7%) stand out. There is also a significant presence of Belgium, Ireland, Argentina, and China, demonstrating Valencia's consolidation as an urban tourist destination with great international appeal.

In terms of categories, 4-star hotels have reached 85.3% occupancy and 5-star hotels 80.1 % , both below the 2024 figures. However, the forecast for the second half of the month (82.9%) points to a recovery in tourism growth in the capital.

PROVINCE OF CASTELLÓN

The first half of May 2025 closed in the province of Castellón with a hotel occupancy rate of 64.5% , slightly below the 66.9% recorded in the same period in 2024. This moderation is particularly noticeable in the 4-star category , which rose from 66.8% to 62.5% this year.

The domestic market remains the clear majority, with a 77.7% share , practically at the same level as the previous year (77%). Among international markets, France remains the main foreign issuer with 5.4% , although significantly lower than the 8.4% in 2024. It is followed by the United Kingdom, Italy, Germany, and Romania, although all with moderate percentages. There is also a residual but diverse presence in markets such as China, the United States, the Netherlands, and Belgium.

Looking ahead to the second half of May , forecasts point to a slight continuation of the current trend, with an estimated occupancy rate of 62.7% , which could consolidate a moderate May for the destination.

First for the latest UK & Spanish news on the hour every hour!

Latest Music Video's

Spain's More Music Variety