Valencia is resisting hotel recovery, dropping hotel occupancy by more than 5 points in July.

- The rest of the Valencian Community has seen improved occupancy rates, with Benidorm leading the sector with 90%.

- The domestic market is suffering for Valencian hotels, except in Castellón, which experienced a strong boost in the second half of July, growing 8 points compared to the first half.

Hotel occupancy data for July reveals some of the key aspects of the tourist season and highlights the strengths and weaknesses experienced by the hotel and tourism sector in the Valencian Community.

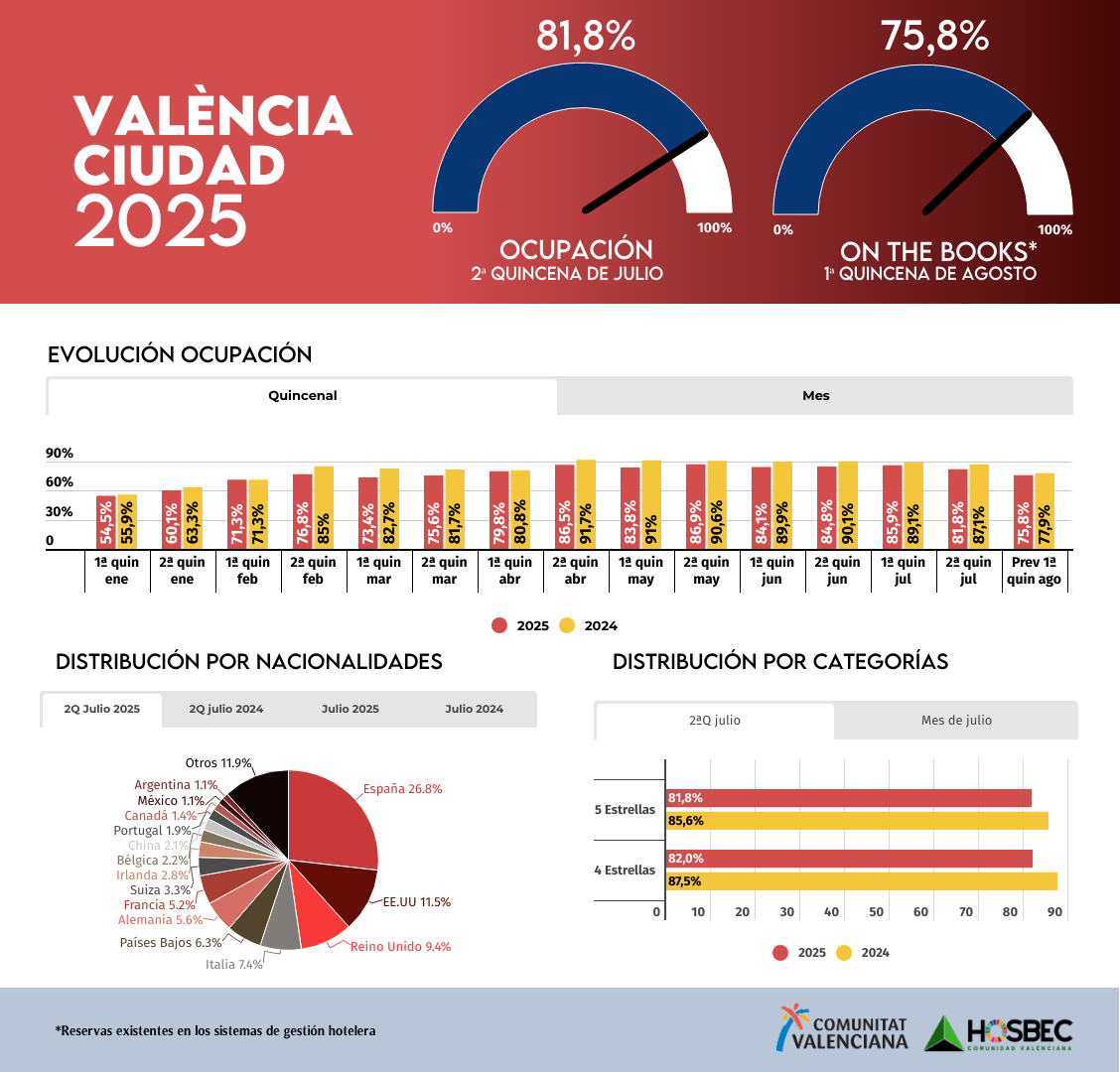

The first key factor is the performance of the city of Valencia and the forecasts for the first half of August: the second half of July saw a drop of more than 5 points in occupancy, falling below 82%, and the forecast currently does not exceed 76% for the first half of August. Among the key factors behind this decline is the continuing fallout from the Dana effect, as well as the weakness of the domestic market, which only accounts for 27% of the total, while the international segment accounts for 73%.

Among the interesting data is the American market, which leads the international market with a combined share of 13% between the US and Canada.

Castellón has experienced one of the largest increases in the hotel sector, with average hotel occupancy in the second half of the month reaching 84% compared to 75% in the first half. In Castellón, the domestic market remains the predominant and majority market, with a share close to 87%. The forecast for the first half of August is also noteworthy, already indicating an 8-point increase compared to last year.

Benidorm and the Costa Blanca are following the forecast roadmap and have seen slightly improved hotel occupancy figures compared to last year, but technical full capacity has not been reached, so the sector cannot speak of overcrowding. Between 10% and 15% of hotel supply has remained unsold.

Benidorm is the location in the Valencian Community with the best hotel occupancy figures, averaging 90% in July. In the analysis of its markets, we find that for the first time in many years, British tourists staying in hotels outnumbered domestic tourists (38.3% versus 37.9%) during the first part of summer.

In Benidorm, forecasts and confirmed reservations for the first half of August are 3 percentage points higher than August 2024.

Fortnightly report on hotel occupancy evolution – 2nd half of July 2025

Below, we offer a detailed analysis of hotel occupancy rates in different locations in the Valencian Community.

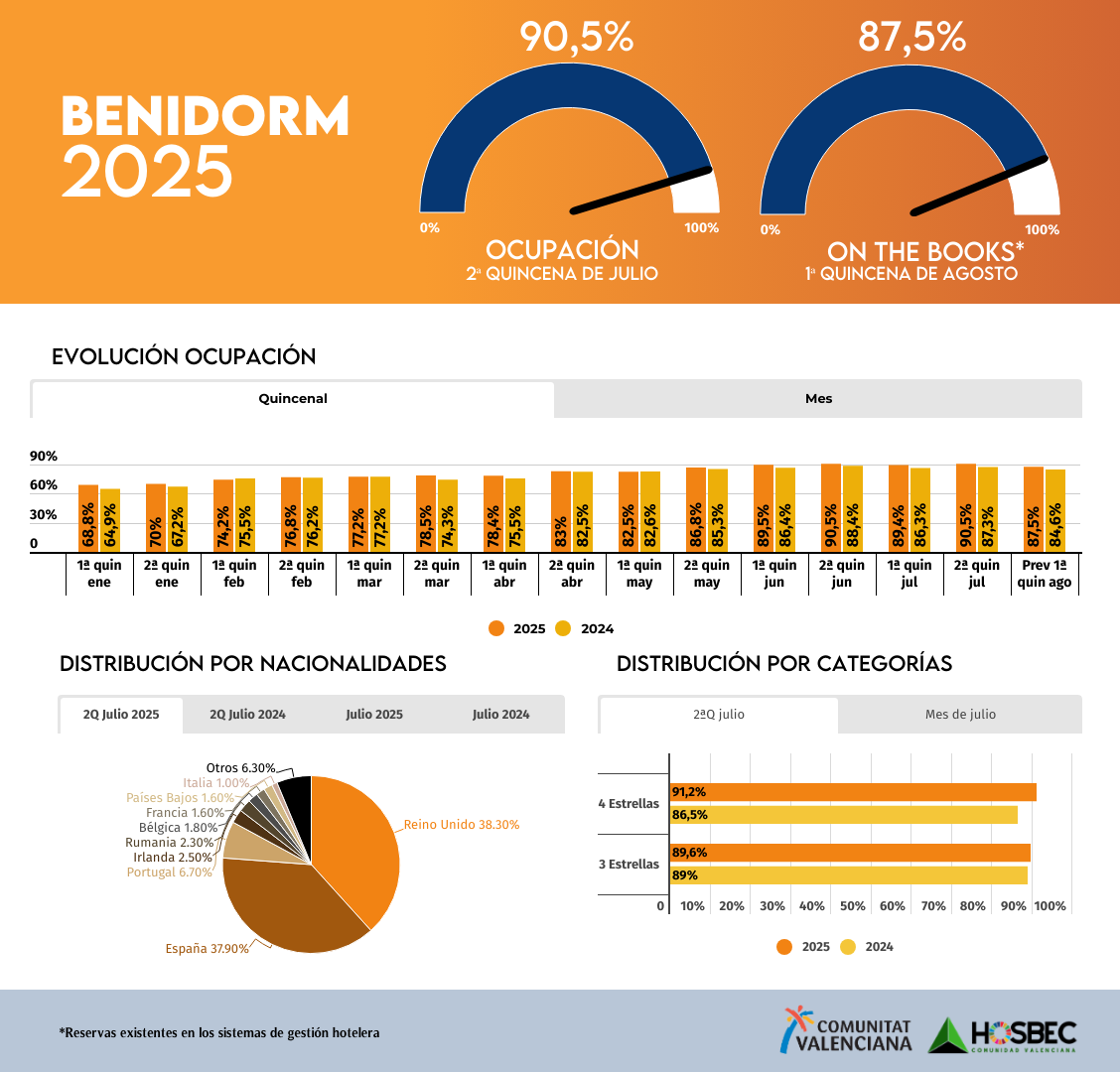

BENIDORM

Benidorm has seen its second half of July achieve a 90.5% hotel occupancy rate , improving by 3.2 percentage points on the same period last year (87.3%). This boost also consolidates the full month, which closes with an 89.9% occupancy rate , compared to the 86.8% achieved in July 2024. The destination's performance continues its upward trend, especially after a June that also ended with positive results.

Demand has been very evenly distributed between domestic and international visitors: the United Kingdom (38.3%) and Spain (37.9%) lead the ranking of markets in the second half of the year, followed by Portugal (6.7%), Ireland (2.5%), and Romania (2.3%). This summer, British tourists have regained their presence compared to 2024, while Spanish tourists have slightly decreased their presence, although they remain key to the destination.

By category, 4-star hotels reached 91.2% occupancy in the second half of July, up almost 5 percentage points year-over-year. 3-star hotels remained stable at 89.6%. Benidorm's hotel sector once again demonstrates its high attractiveness and performance, both in terms of quality and volume.

Looking ahead to August, bookings are already confirming a continuation of the positive trend: the first half of the month is 87.5% booked , signaling another period of high activity for the Valencian Community's main tourist destination.

COSTA BLANCA AND SOUTH ALICANTE

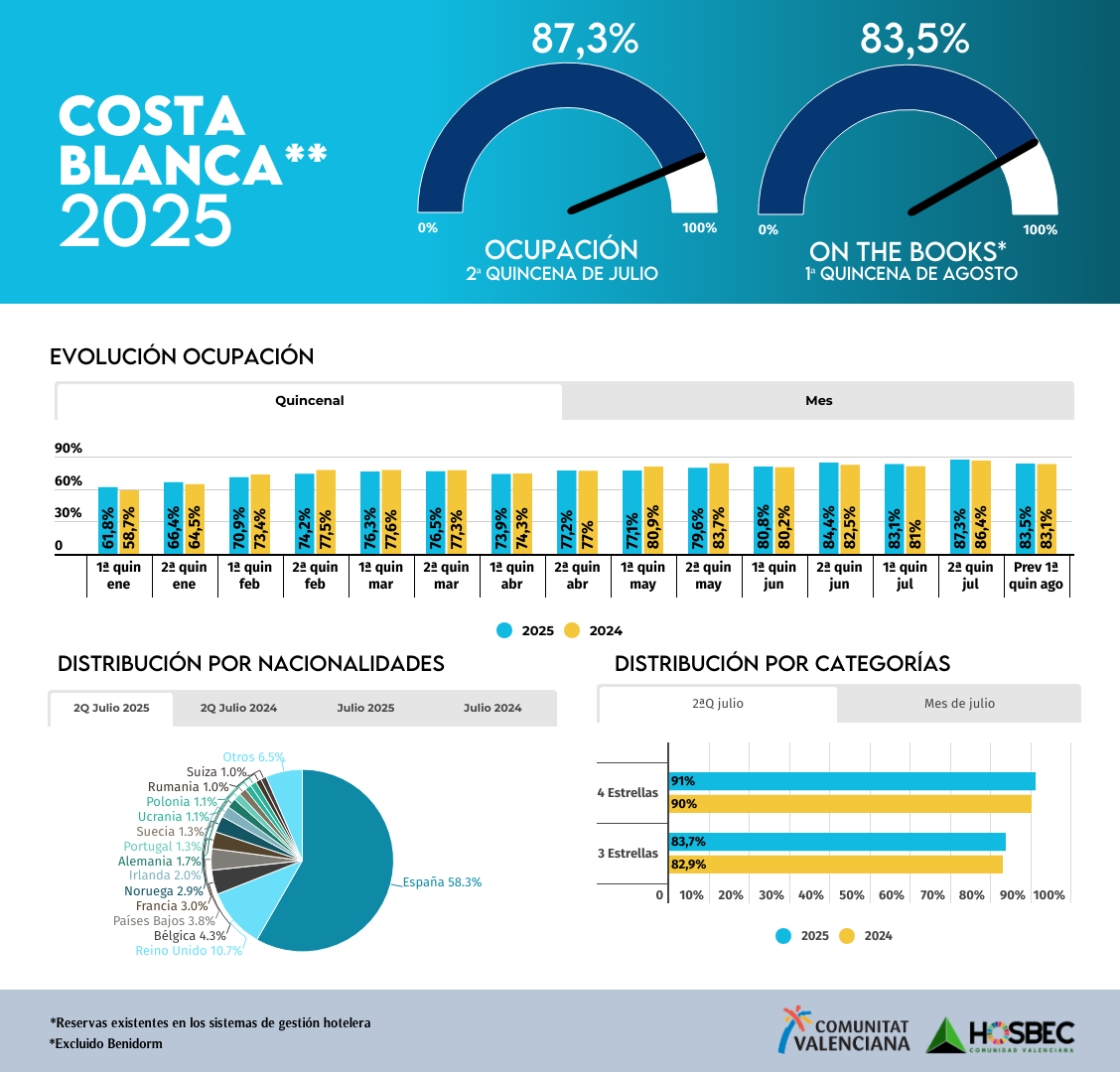

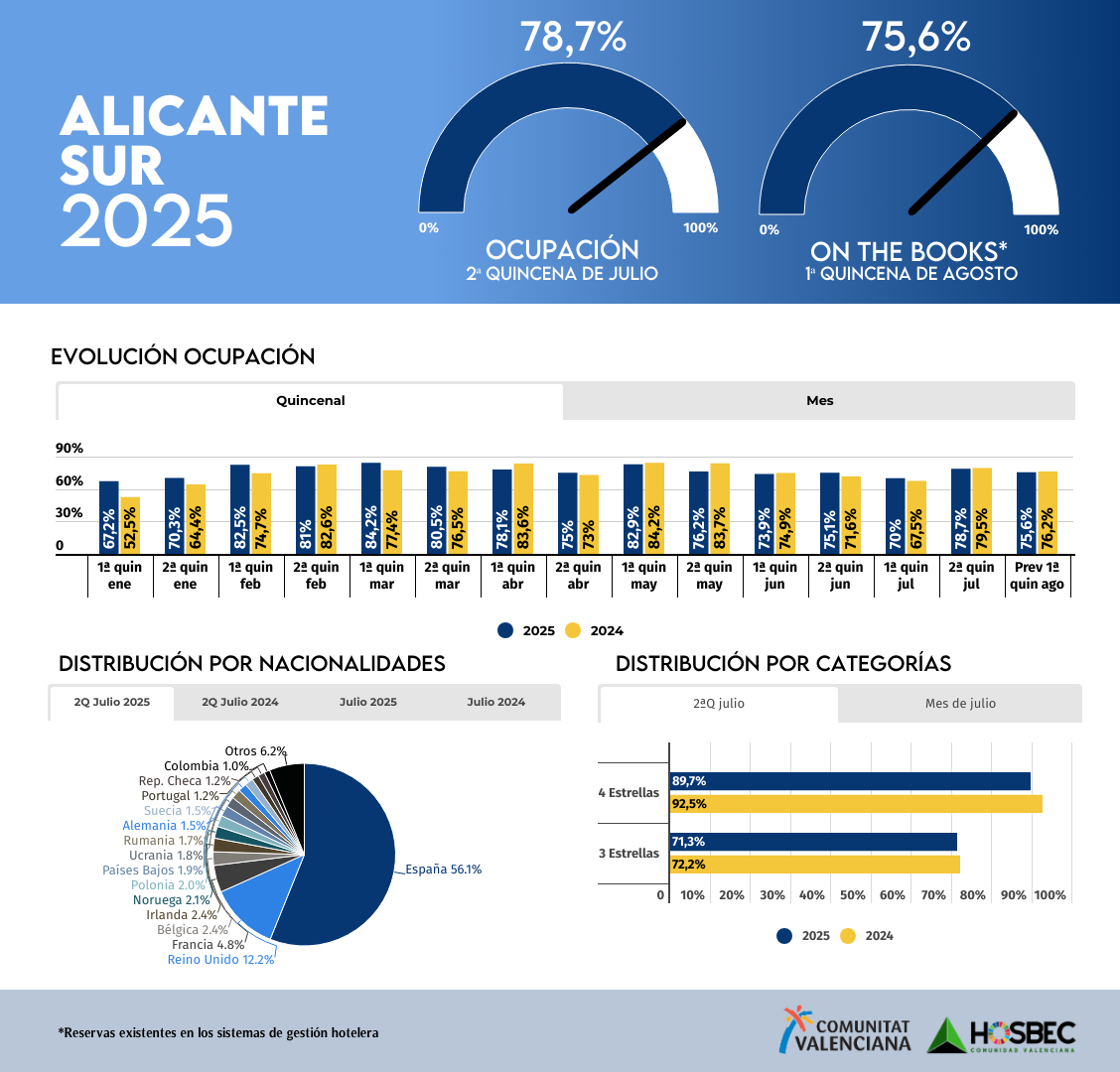

The Costa Blanca faces the final stretch of July with figures that reinforce its position as one of the most solid areas in the Mediterranean. In the second half of July, hotel occupancy reached 87.3% , improving by almost one point on the figures for the same period in 2024. Established tourist destinations such as Altea (94.5%) , Calpe (89.6%) , and l'Alfàs del Pi – El Albir (84.6%) have registered particularly outstanding figures, underpinning the strength of the region's accommodation offering. Focusing on Alicante South , we see that, although with a somewhat more contained evolution, it remains at good levels at 78.7% , a slight decrease compared to 79.5% last year.

The data by category consolidates the attractiveness of the hotel offerings in both destinations. On the Costa Blanca, 4-star hotels shine with 91% occupancy, while 3-star hotels reach 83.7%. In the case of Alicante South, 4-star hotels reach 89.7%, while 3-star hotels stand at 71.3%. Although slightly lower, these figures demonstrate a loyal and sustained clientele.

Regarding the origin of tourists, the domestic market continues to lead the way, but is beginning to give way to international recovery. On the Costa Blanca, Spaniards account for 58.3% of visitors, while in Alicante South the figure stands at 56.1%.

The United Kingdom was the most prominent foreign market in both regions: 10.7% on the Costa Blanca and an impressive 12.2% in Alicante South, confirming the British pull on the Alicante coast. Also notable were French (4.8% in Alicante South and 3% on the Costa Blanca), Belgians (2.4% and 4.3% respectively), and Norwegians (2.1% and 2.9%), demonstrating a growing interest from Northern Europe in our climate and coast.

Countries such as Ireland (2.4% in Alicante South and 2% on the Costa Blanca) and Germany (1.5% and 1.7%) maintain a stable presence, while markets such as Ukraine, Poland, Sweden, and Portugal together account for a significant volume, reinforcing the diversity of origins. This geographic breadth translates into a more balanced demand that is less dependent on any single country.

The monthly balance is also positive: Costa Blanca closes July with 85.2% occupancy, compared to 83.7% the previous year; and Alicante Sur improves its overall figure to 74.4%, gaining more than a point compared to 2024. The forecast for the first half of August reinforces this optimism: the "on the books" data already places the expected occupancy at 83.5% on the Costa Blanca and 75.6% in Alicante Sur. Everything indicates that the star month of summer will continue its upward trend.

PROVINCE OF VALENCIA AND VALENCIA CITY

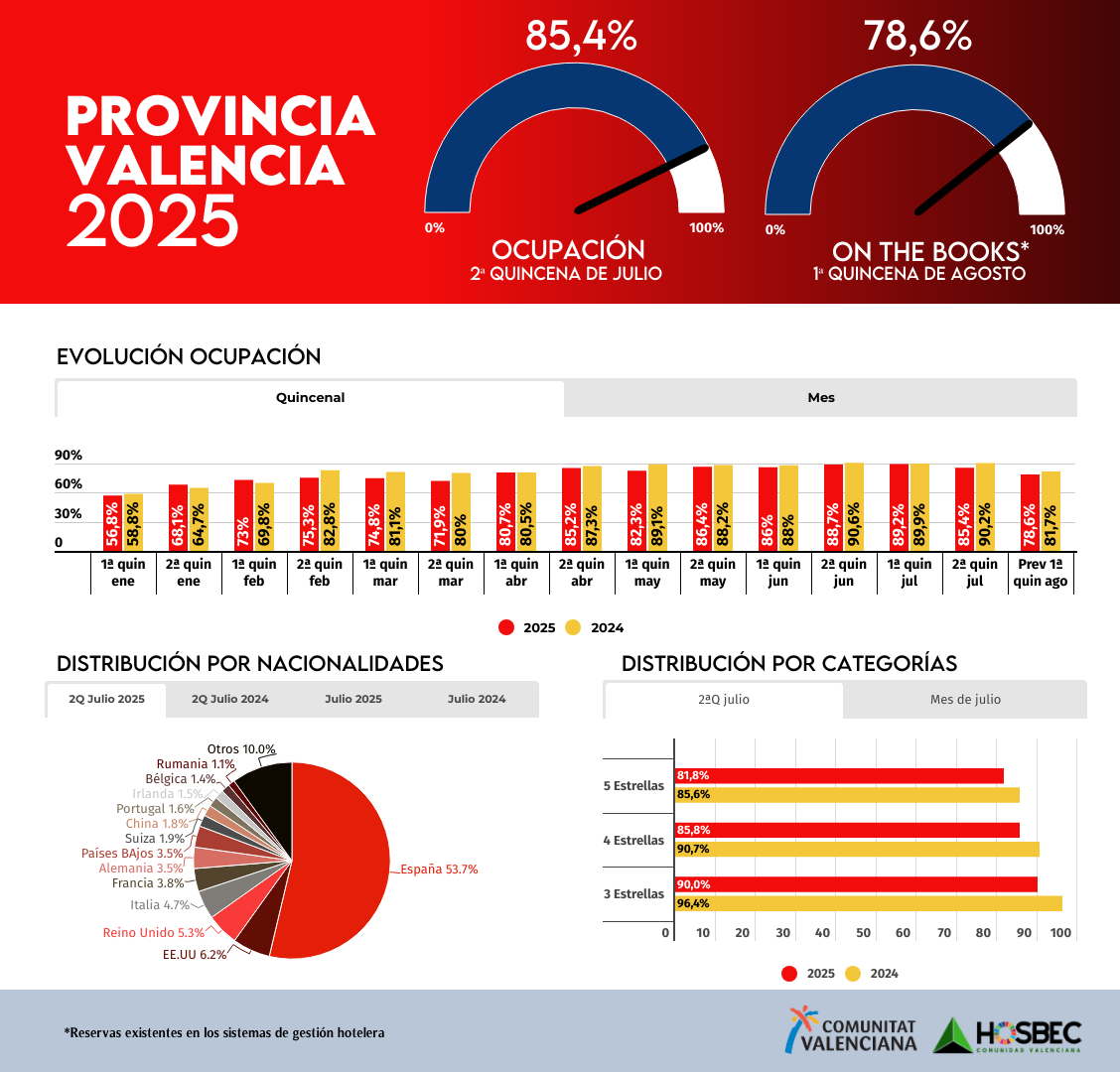

The province of Valencia closed the second half of July with a hotel occupancy rate of 85.4% , a drop of almost five points compared to the same period last year. This downward trend is also reflected in the overall figure for the month, which stands at 87.2% compared to 90.1% in July 2024. Despite this decline, the figures continue to show a significant level of tourist activity. Particularly noteworthy is the performance of Gandía , which recorded 90.2% occupancy in the second half of the month, with demand clearly driven by the domestic market , which accounted for 90% of total visitors.

Spanish travelers remain the majority during the second half of the month ( 53.7% ), but there are also notable increases in markets such as the United States (6.2%) and the United Kingdom (5.3%) , in addition to the positive response from Italy, France, the Netherlands, and Germany , all above 3%. This diversity in visitor origin demonstrates a mature destination that maintains the interest of a wide range of audiences.

Although all hotel categories have seen a slight decline compared to last summer, they remain at solid levels, especially in 3- and 4-star hotels.

In the case of Valencia city , the analysis confirms a more pronounced slowdown, albeit within a context of figures that are still at high levels. The second half of July closed with an occupancy rate of 81.8% , clearly below the 87.1% recorded in 2024. The monthly cumulative figure reflects a similar trend, with 83.8% compared to 88.1% the previous year.

In terms of visitor profile, Valencia maintains its international character, with a much lower representation of domestic tourists than other destinations in the Valencian Community : only 26.8% of travelers during this second half of the month come from Spain . The very strong presence of tourists from the United States stands out, representing 11.5% of the total, consolidating the North American market as a strategic pillar. They are followed by the United Kingdom (9.4%), Italy (7.4%), the Netherlands (6.3%), Germany (5.6%), and France (5.2%), all of which have significant shares.

Regarding reservations for August, the "on the books" data points to a dynamic start to the month in both destinations. The province of Valencia begins the first half of the month with 78.6% occupancy already confirmed , while in Valencia city the figure stands at 75.8% . Although the figures are somewhat more modest than in previous years, they show a stable trend that allows the sector to approach the central stretch of summer with caution, but also with firm expectations of tourism consolidation.

PROVINCE OF CASTELLÓN

Castellón continues to consolidate its appeal as a summer holiday destination, with a notable improvement in its hotel occupancy rates. During the second half of July, the province's hotels reached an average of 83.9% occupancy , a significant increase compared to the same period last year. On a monthly basis, July closed with 79.7% occupancy , reflecting a very stable performance and slightly higher than in 2024.

The influence of domestic tourism is, once again, the key to hotel performance in this region. With an 87.2% share in the second half of the year, Spanish visitors maintain their market dominance , accompanied to a lesser extent by clients from France, Romania, and the United Kingdom. International diversity remains modest, though constant.

By category, the four-star hotel sector—the largest in the province—recorded an average occupancy rate of 86.2% in the second half of the month, a figure that directly contributes to the destination's overall positive performance.

Regarding the forecast for August, the available data shows a positive start: hotels have already booked 78.6% of their rooms for the first half of the month. A solid starting point that inspires optimism ahead of the busiest stretch of the tourist season.

First for the latest UK & Spanish news on the hour every hour!

Latest Music Video's

Spain's More Music Variety